Open Admissions + First Semester Loans = Bad Student Outcomes

Consider the following; _ According to National Center for Education (NCES) statistics, 61% of college-bound students require remedial education. _ Of that remedial cohort, only 24.5% ever graduate from college. _ According to NCES, 90% of student loan defaults are by college dropouts. 8% are by certificate or associate graduates, and, contrary to opinion, only

Continue Reading >>>

Give the Obama Student Loan Servicing Plan a Chance

Guest Post by Deanne Loonin (attorney and advocate for low-income student loan borrowers) Programs to help struggling student loan borrowers will only succeed if servicers effectively do their jobs and provide high quality information and assistance. Servicers are a borrower’s primary point of contact. Ideally, they should provide borrowers with accurate and comprehensive information about

Continue Reading >>>

Why We Need A Strong Student Debt Relief Rule

The Obama Administration is on the verge of issuing a proposed rule that would create new procedures and standards for cancelling the federal student loan debt of people who were defrauded by their colleges. The rule would also create new standards for the Department of Education to require colleges to post escalating letters of credit based

Continue Reading >>>

Education Dept To Give Debt Relief To More Corinthian Students

The U.S. Department of Education says that at an event scheduled for today in Boston with Massachusetts Attorney General Maura Healey, Secretary of Education John B. King Jr. will announce that students who attended 91 former Corinthian Colleges campuses nationwide between 2010 and 2014 “have a clear path to loan forgiveness under evidence uncovered by the Department while working

Continue Reading >>>

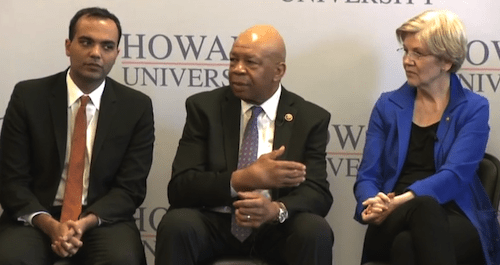

Rohit Chopra Joins Department of Education

Rohit Chopra, whose principled and determined leadership helped make the Consumer Financial Protection Bureau a strong force in addressing the abuses of predatory for-profit colleges, has joined the U.S. Department of Education as a senior adviser. Chopra is working directly for Under Secretary Ted Mitchell, focusing on protections for students, analysis of financial capacity and

Continue Reading >>>

Unrepentant EDMC CEO Will “Push Back” Against Gainful Employment Rule

At a press conference this morning, the Justice Department, the Department of Education, and a group of state attorneys general announced what Attorney General Loretta Lynch called a “landmark settlement” of fraud charges against for-profit college company Education Management Corporation (EDMC). The company will pay $95.5 million — the largest False Claims Act settlement ever

Continue Reading >>>

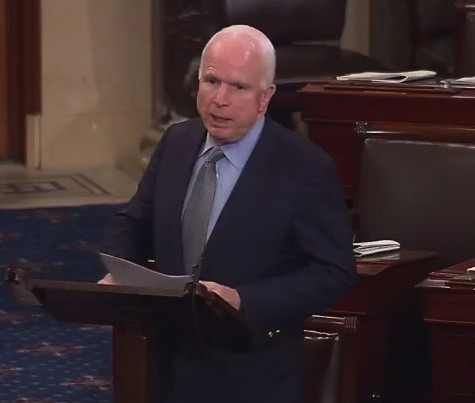

McCain Lashes Out At Durbin, Defends Veteran-Abusing For-Profit Colleges

Senator John McCain (R-AZ), in a speech on the Senate floor yesterday afternoon, charged that fellow Senator Dick Durbin (D-IL) has “orchestrated” a “shameful … vendetta against for-profit universities.” McCain upped the ante by asserting that Durbin has a “well-known record of not supporting the men and women who are serving in the military.” Alleging a larger conspiracy,

Continue Reading >>>

For-Profit College Owner, Who Used Strippers As Lure, Goes On Trial

Alejandro Amor (pictured just above), the former owner-CEO of for-profit FastTrain College, is scheduled to face a jury trial in Miami Wednesday morning. Amor and his co-defendant, former FastTrain admissions staffer Anthony Mincey, face criminal charges of defrauding the federal government to obtain about $6.5 million in student aid — Pell grants and Direct Loans. Two other FastTrain employees charged

Continue Reading >>>