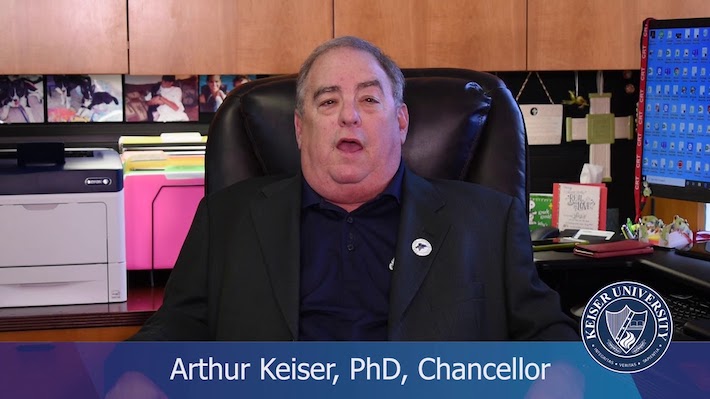

Inside Arthur Keiser’s College Empire: Troubling Evidence

A close look into Arthur Keiser’s college operations, based on accounts by former school officials and employees, raises new questions about predatory recruiting, conflicts of interest, executive misconduct, and the validity of the non-profit status of his schools. Southeastern College is a Florida-based for-profit career school offering programs in health care, information technology, and business.

Continue Reading >>>

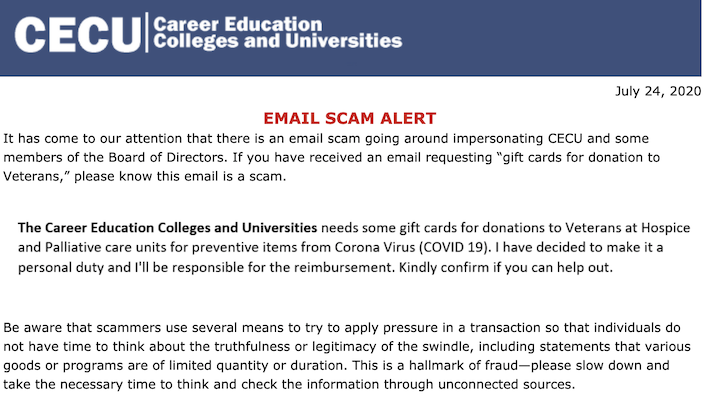

For-Profit College Group Warns Members They Are Being Targeted By High-Pressure Scam

Last week, the for-profit college lobby group CECU sent a message to its members entitled, “EMAIL SCAM ALERT.” It warns, “It has come to our attention that there is an email scam going around impersonating CECU and some members of the Board of Directors. If you have received an email requesting ‘gift cards for donation

Continue Reading >>>

For-Profit Colleges Race To Block Students From Suing Them

Donald Trump and his education secretary Betsy DeVos, over the objections of bipartisan majorities in both houses of Congress, recently rewrote a key federal regulation so that going forward it will be almost impossible for former students who were deceived and ripped off by their colleges to have their federal loans cancelled, even though a

Continue Reading >>>

DeVos Advances Trump-Like Vendetta Against College Accreditor

Betsy DeVos’s Department of Education is pursuing punishment of a college accrediting agency — an action that looks like a Trump-like vendetta and a means of deflecting charges that the Department and a controversial college chain were caught conspiring to cover up abuses. A new Department of Education staff report claims that the accreditor, Higher

Continue Reading >>>

DeVos Tries Everything to Force Deceived Students to Repay Loans

Betsy DeVos’s four-year immoral crusade to harm American education has included a thoroughly corrupt effort to protect predatory for-profit colleges and force students who were scammed by these schools to pay back their student loans anyway. Advocates for veterans, single mothers, immigrants, and others ripped off by for-profit colleges have been determined to fight back.

Continue Reading >>>

Florida Career College Works to Silence Former Employees

Just days after Republic Report published an article, based on interviews with former employees of Florida Career College, about abuses at the school, the college’s parent company wrote to ex-staffers warning them to keep quiet, or else possibly be sued. In letters to former employees, attached to emails sent last week, Aaron Mortensen, general counsel

Continue Reading >>>

College Owner Who Heads DeVos Panel Is Sued By Mother For Alleged Fraud and Theft

Arthur Keiser, the politically-connected “Chancellor and CEO” of Florida-based Keiser University, has been sued by his 96-year old mother for allegedly cheating her out of income generated by businesses they own together — an escalation of a messy family dispute over a lucrative for-profit college fortune, with damaging charges and counter-charges and an effort by

Continue Reading >>>

Ex-Employees: Florida Career College Enrolled “Anyone With a Pulse”

The Orlando campus of Florida Career College, according to former employees there, would enroll, as one of them put it, “anyone with a pulse,” even though the school’s programs often failed to help students succeed. According to the ex-employees, the for-profit college’s recruiters found homeless people in strip mall parking lots and lured them to

Continue Reading >>>